Client Experience Journey

Background

Our UX team conducted client experience research for the new Tax Professional software which will be used by all agents across the country in all retail locations, and we plan to also enable it for other external clients in the next phase.

Our Tax Pros in retails are using an application that could help them do their daily tasks, however, it is not user-friendly, and it is hard to learn.

Current Challenges

Software limitation:

- Limited functionalities – many manual steps, easy-to-make mistakes

- Inconsistency – the incremental changes made the software hard to learn, and hard to use. Not user-friendly.

- Outdated look and feel – does not look professional

Our Tax Pros have experiences vary in a wide range. From new graduates to professionals who years of experience. Like in many industries, our staff have different experiences and comfort levels with online applications.

Our Goals

Our goals in this research project are

- Finding out our customer journey when filing returns in a retail office

- What steps involve during the process

- What are the pain points with the current software

- What our users like to see in the future software

- Collect data to improve customer satisfaction

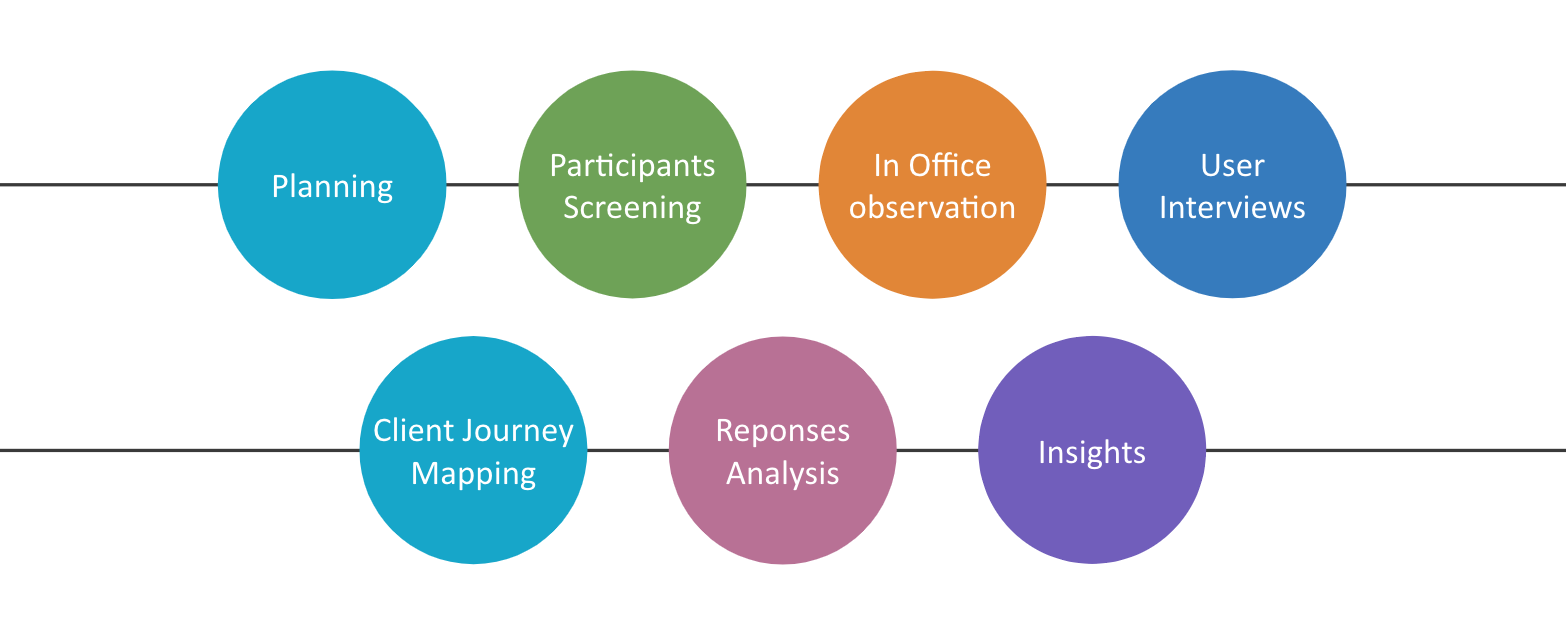

UX Process

By the numbers:

2 cities (Calgary & Toronto)

4 UX researchers

13 retail offices

16 research sessions

40+ hours of observation

492 highlighted notes

In-office observation study

We scheduled observation times with our Tax Pros to observe how they filed taxes for clients. Since this involved our clients, we ensured and obtained consent from our clients before each observation session.

During the observations, we observed how Tax Pros interact with clients, and we took detailed notes with direct quotes.

User Interviews

To gain insight into the problems our users faced, we created a set of opened-ended questions for the interviews. These questions encouraged more elaborative responses to include information, including feelings, and attitudes which allowed us to better access their true feelings and pain points on issues. In addition, some of the questions were designed to be similar and were spread throughout the interview, so we got answers from multiple angles.

For each tax pro we interviewed, we started by introducing ourselves, providing some background information, and the purpose of the study.

Client Journey Mapping

- We put all our findings into the Dovetail tool and use it to help us analyze the information.

- We tag and group the data, and organize it to see the pattern.

- From the data, we highlight and find the insight for each problem.

- We organized our findings and presented them to our department, Product Owner, and Developments.

- The final insight document is actually more than 100 pages in PowerPoint document with over 50 insights and improvements.

- We did not just stop here, we track all the insights into our backlog so we could prioritize them and build the software backing with supportive research.

- From the recommendations, we prioritize the road maps of new features.

Insights

- There are a TON of interruptions in the tax return appointment

- Tax pros struggle to find answers on their own

- Online Appointment Booker has a lot of limitations

- Clients don’t have a good understanding of what to bring to their appointments

- Poor client matching causes friction

- Non-transparent pricing is challenging

Takeaways

Don’t make assumptions

I’ve learned that don’t make assumptions. I learned to ask very simple questions that may sound useless. But I found out that I would have missed a lot of key information if I assuming the answers to basic questions. Such as “What are your work hours?” I could have simply assumed a 9-5 is a very standard answer. But actually, Tax Pros’ hours are very different. Some actually work 9 to 5, but there are many, of their work hours depend on their client’s schedules. Some work part-time, and only works in the evening. Knowing their work hours could help us understand why some tax pros are also Client Service representatives. What does it mean to our software? We need to consider Autosave, lock screens, and features that could protect clients’ data

Sharing knowledge

It’s not easy to make people share what they know, so staying clear in the beginning that the purpose of our studies and building trust is important, before we can get in-depth details of the problems the tax pros face.

Embrace silence

Sometimes silence during interviews may seem awkward, but during user interviews, instead of filling up with small chats, I found the person being interviewed actually filled up the silence by providing more insights and in-depth details.

Be open to opinions and feedback

The main reason to do user research is to get real user feedback, however, feedback may not always be present, and there are times when the truth is hard. I’ve learned to be a good listener. When conducting the research, not trying to validate the software or defend our team, but listening with an open mind so I can provide truthful feedback.

Ask the right questions

Some suggested features by users may not be what they actually need, and thus not valuable to overall solutions. Our job as designers is to find out what people’s problems are, and then build for the future. So instead of asking “What would you like us to do”, we asked our Tax Pros to show us the way they work, and asked what they were trying to accomplish – so we can design for them.

Observer Effect

Some suggested features by users may not be what they actually need, and thus not valuable to overall solutions. Our job as designers is to find out what people’s problems are, and then build for the future. So instead of asking “What would you like us to do”, we asked our Tax Pros to show us the way they work, and asked what they were trying to accomplish – so we can design for them.